Starmer declines to rule out election pledge-breaking tax rises in budget after claim Treasury must fill £40bn deficit – UK politics live | Politics

Starmer declines to rule out election pledge-breaking tax rises in budget, after claim Treasury must fill £40bn deficit

Keir Starmer has defended the government’s handling of the economy, but declined to rule out tax rises in the autumn budget.

Speaking to broadcasters on a visit to Milton Keynes today, he also claimed that he did not “recognise” some of the figures in a thinktank report claiming that in the budget in the autumn Rachel Reeves will need to address a deficit of more than £40bn.

The National Institute of Economic and Social Research argues that tax rises will be needed to plug the hole in government finances. (See 9.39am.)

At PMQs last month Starmer said he was still committed to Labour’s manifesto commitment not to raise income tax, employee national insurance or VAT.

But today, when he was specifically asked in an interview if the Treasury was still ruling our raising these three taxes, Starmer did not give that assurance. Instead he said:

In the autumn, we’ll get the full forecast and obviously set out our budget.

The focus will be living standards, so that we will build on what we’ve done in the first year of this government.

We’ve stabilised the economy. That means interest rates have been cut now four times.

For anybody watching this on a mortgage that makes a huge difference on a monthly basis to how much they pay.

In the first year, we’ve raised wages as well, both in the private sector plus the minimum wage, which means people have got a bit more money coming into their pocket, and so at this stage that will be set out in the budget, but the focus will very much be on living standards and making sure people feel better off.

Asked whether he disagreed with economists warning tax rises in the budget would be necessary to raise revenue, Starmer replied:

Some of the figures that are being put out are not figures that I recognise, but the budget won’t be until later in the year, and that’s why we’ll have the forecast then and we’ll set out our plans.

What’s really important is that I’m very clear about our focus, which will be on living standards and making sure that people feel better-off, partly because more money is coming into their pocket in the first place through better wages, and partly because we’re bearing down on costs like mortgages and other costs to everyday families.

Key events

The Labour MP Andy McDonald says today’s National Institute of Economic and Social Research report (see 9.39am) shows why the government should consider a wealth tax. In a statement he said:

The time is right to treat the taxation of wealth seriously.

Labour’s Plan for Change must mean that the austerity endured in public services and in peoples pay packets is over and that we ask the wealthy who disproportionately benefited under the Conservatives pay their fair share.

We need to level up existing tax rates on unearned wealth – like capital gains tax – to match rates on earned income. But it’s also time to consider a new tax on wealth.

And it’s clear that many millionaires and billionaires accept this is right and recognise that this country has given them every opportunity to thrive and prosper and they are willing and able to make a greater contribution given the parlous state of the nation’s finances. They should be listened to.

There is growing support in the Labour party for a wealth tax – even though the idea has been dismissed by at least one cabinet minister, Jonathan Reynolds, as ‘“daft”.

Last month Matthew Taylor and Richard Partington wrote this explainer about how a wealth tax might work.

Starmer declines to rule out election pledge-breaking tax rises in budget, after claim Treasury must fill £40bn deficit

Keir Starmer has defended the government’s handling of the economy, but declined to rule out tax rises in the autumn budget.

Speaking to broadcasters on a visit to Milton Keynes today, he also claimed that he did not “recognise” some of the figures in a thinktank report claiming that in the budget in the autumn Rachel Reeves will need to address a deficit of more than £40bn.

The National Institute of Economic and Social Research argues that tax rises will be needed to plug the hole in government finances. (See 9.39am.)

At PMQs last month Starmer said he was still committed to Labour’s manifesto commitment not to raise income tax, employee national insurance or VAT.

But today, when he was specifically asked in an interview if the Treasury was still ruling our raising these three taxes, Starmer did not give that assurance. Instead he said:

In the autumn, we’ll get the full forecast and obviously set out our budget.

The focus will be living standards, so that we will build on what we’ve done in the first year of this government.

We’ve stabilised the economy. That means interest rates have been cut now four times.

For anybody watching this on a mortgage that makes a huge difference on a monthly basis to how much they pay.

In the first year, we’ve raised wages as well, both in the private sector plus the minimum wage, which means people have got a bit more money coming into their pocket, and so at this stage that will be set out in the budget, but the focus will very much be on living standards and making sure people feel better off.

Asked whether he disagreed with economists warning tax rises in the budget would be necessary to raise revenue, Starmer replied:

Some of the figures that are being put out are not figures that I recognise, but the budget won’t be until later in the year, and that’s why we’ll have the forecast then and we’ll set out our plans.

What’s really important is that I’m very clear about our focus, which will be on living standards and making sure that people feel better-off, partly because more money is coming into their pocket in the first place through better wages, and partly because we’re bearing down on costs like mortgages and other costs to everyday families.

Rwanda has agreed a deal with the US to accept 250 illegal migrants being deported by Donald Trump’s administration. According to a report by Jane Flanagan for the Times, Rwanda is expected to house them in “reception centres and apartment complexes originally built for asylum seekers under the British‑funded deportation plan” agreed by the Tories but then dropped by Labour before it started operating.

Ed Davey urges Starmer to intervene with Trump to get him to persuade Israel to abandon ‘full occupation’ Gaza plan

Ed Davey, the Liberal Democrat leader, has urged Keir Starmer to call Donald Trump to encourage him to use his influence to block Israel’s plans for a “full occupation” of Gaza.

In a statement, Davey said:

[Israeli PM Benjamin] Netanyahu’s latest proposals for the occupation of all of Gaza are utterly horrifying.

If realised, they will only wreak yet more destruction on Gazans – while gravely endangering the lives of the hostages still held in Hamas’ captivity.

Keir Starmer needs to pick up the phone to President Trump ahead of the Israeli security cabinet’s meeting tomorrow, and get him to do the right thing – by placing genuine pressure on Netanyahu to drop these proposals. Only renewed diplomacy can end the suffering in Gaza and get the hostages home.

Rather than sitting on its hands, the UK government needs to show leadership in this moment.

This is from Chris Giles, economics commentator at the Financial Times, on Bluesky on today’s NIESR report.

I see NIESR is talking today about a £41.2bn hole in the UK public finances

Two things are newsworthy:

a) NIESR is an outlier

b) Its last forecast (May) had a £60bn ish hole

Does that make it good news for the chancellor today, then?

The Cabinet Office spent more than £30,000 trying, under the previous government, to block the publication of a questionnaire used by ministers to declare their financial interests, Phil Kemp says in a report for the BBC.

Nandy says she won’t watch latest MasterChef after presenter controversy

Lisa Nandy, the culture secretary, has said she won’t be watching the latest series of MasterChef on BBC because of the controversy over the conduct of its sacked presenters, but stopped short of saying the broadcaster should not show it. Ben Quinn has the story.

Ethics watchdog says it is ‘inappropriate’ for Labour to keep system letting ministers direct Electoral Commission

Keir Starmer’s new ethics watchdog has criticised ministers for failing to give up “inappropriate” powers to influence the Electoral Commission.

In a letter to the democracy minister, Rushanara Ali, Doug Chalmers objected to the government’s plans to issue a new “strategy and policy statement” for the Electoral Commission.

The statement would replace one issued by the previous Conservative government and set out priorities for the Electoral Commission to follow.

But Chalmers argued that it was wrong when the last government changed the law to allow it to issue guidance of this kind to the commission, and he suggested that ministers should have given up this power.

In his letter he said:

We note that the government intends to designate a new strategy and policy statement for the Electoral Commission. We continue to take the view that it is inappropriate for the government of the day to seek to guide the work of the independent electoral commission. This is a matter we raised with the previous government and continue to believe is an important point of principle.

Chalmers was writing in his role as chair of the Committee on Standards in Public Life, a role he has held since December 2023. But the government has recently announced that it is setting up a new independent ethics and integrity commission, that will also be chaired by Chalmers, replacing the committee he currently leads.

As PA Media reports, the use of a strategy and policy statement to guide the Electoral Commission’s work has proved controversial since it was first proposed in 2021, with Labour figures in opposition saying it set “a dangerous precedent”.

The Electoral Commission itself has also consistently opposed the principle of a strategy and policy statement. Last month, the commission’s chair, John Pullinger, said: “The independence and impartiality of an electoral commission must be clear for voters and campaigners to see, and this form of influence from a government is inconsistent with that role.”

Chalmers was writing to Ali to give his committee’s response to the modern elections strategy she published last month. Chalmers said he was pleased that its proposals for tightening the rules on political donations and protecting candidates from intimidation were in line with recommendations previously made by his committee.

Nandy rejects Tory claim that ‘loophole’ in returns treaty means small boat migrants will easily be able to avoid return to France

Yesterday the Foreign Office published the text of the “one in, one out” returns treaty with France. As Rajeev Syal reports, it says that the UK will pay the costs of transporting asylum seekers to and from France under the deal.

The Times has instead focused on another detail in the text of the treaty and it has splashed on a story by Matt Dathan highlight Tory claims that there is a “loophole” in the treaty. Dathan reports:

Small boat migrants will be able to frustrate attempts to deport them to France under Sir Keir Starmer’s new returns deal by exploiting human rights laws, according to the terms of the treaty …

Migrants cannot be returned to France if they have outstanding human rights claims or other “judicial remedies”, live injunctions or court orders lodged against their removal from the UK.

Confusion over the wording of the treaty caused a political row as it was unclear whether migrants would be able to delay their removal by lodging bogus asylum claims and waiting for the case to be heard in court.

Chris Philp, the shadow home secretary, said the text of the treaty allowed an “easy loophole” for lawyers of migrants to exploit.

The Conservative party has been highlighting this on social media, saying:

Immigrants can’t be deported under Labour’s France deal if they:

❌ Claim to be under 18

❌ File a rights challenge

❌ Face no data checks from France

❌ Get rejected by France without reasonStarmer’s deal is a gift to smugglers.

In an intervew with Sky News this morning, Lisa Nandy, the culture secretary, rejected the claim that a “loophole” in the deal meant small boat migrants would easily be able to avoid being returned to France. She said:

The deal that we’ve struck will allow people with us to send people back to France who have human rights claims. Those claims will be heard in France.

So, I know that the Conservative party has been saying that this is a loophole. It isn’t and we’re really confident about that.

NIESR urges Reeves to consider replacing council tax with land value tax, saying it would raise money and be ‘much fairer’

In an interview with the Today programme about the National Institute of Economic and Social Research’s report about the chancellor’s budget trilemma (see 9.39am), Prof Stephen Millard, the NIESR’s deputy director for macroeconomics, argued that Rachel Reeves should consider reforming council tax. He said:

The council tax system is a mess, really. Houses have not been revalued since 1991. The system is ripe for a complete reform.

The question there is whether reforming the council tax system, getting it right, would necessarily raise any additional money.

An alternative is to replace the whole thing with a land value tax, which is much fairer and which potentially could actually raise a significant amount of money.

During the general election Labour said it was not planning to reform council tax, and it ruled out rebanding properties, but it did give a firm commitment not to alter the system.

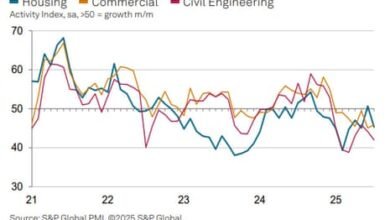

Reeves faces ‘impossible trilemma’ in budget, says NIESR thinktank

The National Institute of Economic and Social Research (NIESR), the thinktank saying Rachel Reeves will need to raise taxes to cover a £40bn deficit in the public finances (see 9.13am), says that the chancellor faces “an impossible trilemma”.

In his foreward to the report, David Aikman, the NIESR director, says:

The UK economy enters the second half of 2025 still confronting weak growth and stubborn inflationary pressures. While external factors – including continued trade policy uncertainty and persistent geopolitical risks – certainly matter, domestic challenges dominate the outlook. Chief among these is the government’s increasingly acute fiscal predicament. Simply put, the chancellor cannot simultaneously meet her fiscal rules, fulfil spending commitments, and uphold manifesto promises to avoid tax rises for working people. At least one of these will need to be dropped – she faces an impossible trilemma.

But it is not really a trilemma, Aikman suggests, because he argues that two of these options are not feasible.

The government is no longer on track to meet its “stability rule”, with our forecast suggesting a current deficit of £41.2bn in the fiscal year 2029–30. With the autumn budget approaching, the chancellor faces unenviable decisions. The spending review has already set departmental budgets tightly until 2029, limiting scope for further cuts. Meanwhile, manifesto commitments restrict the options for tax increases. This leaves the government either breaching its fiscal rules – risking higher borrowing costs or even market instability – or making politically difficult and economically damaging compromises at a time when … the poorest 10% of UK households face a further decline in their living standards this year.

Our view is that it will be crucial for the chancellor to restore market confidence by demonstrating fiscal discipline. This will require a determined attempt to rebuild the fiscal buffer and that will inevitably involve gradual but sustained tax increases or spending cuts. In charting this path, the government must prioritise protecting public expenditure that supports society’s most vulnerable, while safeguarding public investment essential for sustainable future growth.

Rachel Reeves needs to put up taxes to cover £40bn deficit, thinktank says

Rachel Reeves will need to raise taxes to close a government spending gap that is on course to reach more than £40bn after a slowdown in economic growth and higher-than-expected inflation, according to the National Institute of Economic and Social Research (NIESR), a thinktank. Phillip Inman has the story.

‘Worrying’ levels of screen time means young people losing confidence to socialise in person, Lisa Nandy warns

Good morning. Keir Starmer is out on a visit today and he will be doing broadcast interviews. It may be the only time we hear from him this week, and there is no shortage of topics that journalists will want to ask him about. By the end of the day we may get new, or newish, lines on Gaza, the “one in, one out” returns deal with France, tax rises and the black hole in the government’s finances (priced at more than £40bn, according to a report from a well-respected thinktank today), Ukraine, the case for and against disclosing suspects’ immigration status and the demonstration planned for this weekend against the decision to proscribe Palestine Action.

But Starmer wants to talk about something else – less party political, less ‘Westminster agenda’, but arguably as or even more important than these other topics: what the internet is doing to our children.

Officially, Starmer and Lisa Nandy, the culture secretary, are just announcing an £88m investment in youth clubs. But they also want to talk about what they suggest is the harm being done by social media to children, who they say are spending so much time on their screens that they are losing the ability to socialise in person with other people.

In a statement in the government’s news release about the funding, Starmer says:

Growing up today is hard for young people. As they navigate their way through the online world, too often they find themselves isolated at home and disconnected from their communities.

As a government, we have a duty to act on this worrying trend. Today’s investment is about offering a better alternative: transformative, real-world opportunities that will have an impact in communities across the country, so young people can discover something new, find their spark and develop the confidence and life skills that no algorithm can teach.

In an interview on the Today programme, Nandy was asked to elaborate on what this “worrying trend” was. She replied:

It keeps me awake at night. We when we were first elected into government last year, one of the first things that I did was to appoint a group of young people to oversee the first national youth strategy in several decades. I was astonished to find that we didn’t have one.

What we found through that process is that the majority of young people – and it does appear to be a majority – spend all, or almost all, of their free time alone in their bedrooms, online, and are losing their confidence to connect to people in the real world.

A significant number of them say that they have no adult in the world who they would trust to help and support them. That is really, really concerning.

And one of the reasons that we’re announcing this funding today is to open up opportunities to young people in youth clubs and in schools to live richer, larger lives because there is a pressing need for our generation to step up and help before it’s too late.

Here’s Eleni Courea’s overnight story about the initiative.

I will post more from Nandy’s interviews soon.

The Starmer visit is taking place in Hertfordshire this morning. Other than that, the diary is relatively empty, but, of course, that does not mean there will be nothing to cover; news is not always predictable.

If you want to contact me, please post a message below the line when comments are open (normally between 10am and 3pm at the moment), or message me on social media. I can’t read all the messages BTL, but if you put “Andrew” in a message aimed at me, I am more likely to see it because I search for posts containing that word.

If you want to flag something up urgently, it is best to use social media. You can reach me on Bluesky at @andrewsparrowgdn.bsky.social. The Guardian has given up posting from its official accounts on X, but individual Guardian journalists are there, I still have my account, and if you message me there at @AndrewSparrow, I will see it and respond if necessary.

I find it very helpful when readers point out mistakes, even minor typos. No error is too small to correct. And I find your questions very interesting too. I can’t promise to reply to them all, but I will try to reply to as many as I can, either BTL or sometimes in the blog.