UK construction activity shrinks by most in five years as housebuilding falls – business live | Business

UK construction activity falls by most in five years as residential building drops

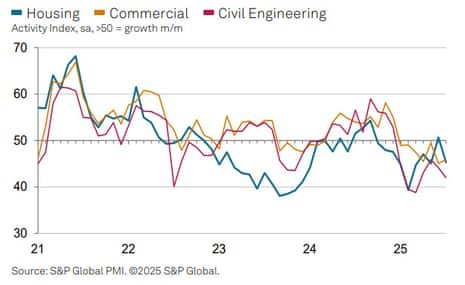

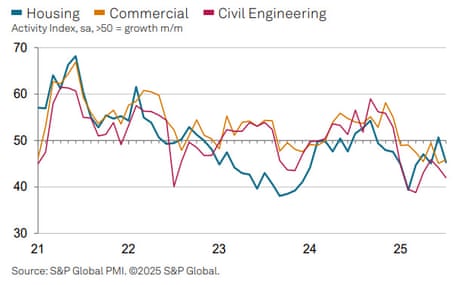

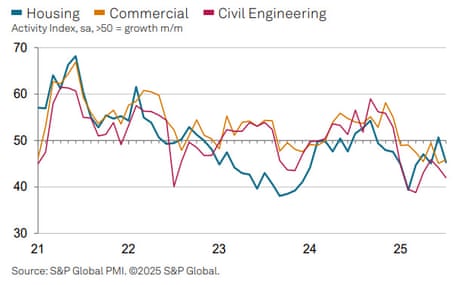

Ouch! Activity in the UK construction sector has fallen at the fastest rate in over five years, indicating the government is struggling to hit its housebuilding targets.

Data firm S&P Global has reported that there was “a considerable slump in the UK construction sector” in July, as builders reported a renewed decline in housing projects.

That is a sign that Labour are falling behind in their target to boost housebuilding and build 1.5 million new homes by 2029.

Commercial construction, and civil engineering, both also shrank in July.

S&P Global says:

Underlying data highlighted marked decreases in volumes of work carried out across all three monitored sub-sectors, but a considerable drag came from a fresh drop in residential building.

This pulled the S&P Global UK Construction Purchasing Managers’ Index (PMI) down to posting 44.3 in July, from 48.8 in June.

Any reading below 50 shows a contraction, and today’s data signals the sharpest contraction in over five years.

Builders blamed site delays, lower volumes of incoming new business and weaker customer confidence for falling activity in July.

Joe Hayes, principal economist at S&P Global Market Intelligence, says UK construction suffered “a fresh setback” in July, explaining:

Dissecting the latest contraction, we can see a fresh and sharp drop in residential building, as well as an accelerated fall in work carried out on civil engineering projects.

Forward-looking indicators from the survey imply that UK constructors are preparing for challenging times ahead. They’re buying less materials and reducing the number of workers on the payroll. Expectations also continue to underwhelm, despite a modest pick-up in confidence from June’s two-and-a-half-year low.

Key events

Disney beats earnings forecasts

Entertainment giant Disney has just beaten Wall Street expectations.

In its latest financial results, Disney reported a 16% rise in adjusted earnings per share to $1.61, beating analysts forecasts of $1.47.

Disney reported:

Income from “Experiences” (Disney’s theme parks) rose by $294m year-on-year to $2.5bn in the quarter.

Income from “Sports” (such as TV channel ESPN) rose $235m to $1bn.

But income from “Entertainment” (such as Disney+ and Hulu) fell by $179m to $1bn.

CEO Bob Iger said Disney was pleased with its “creative success and financial performance” in the last quarter, adding:

“The company is taking major steps forward in streaming with the upcoming launch of ESPN’s direct-to-consumer service, our just-announced plans with the NFL, and our forthcoming integration of Hulu into Disney+, creating a truly differentiated streaming proposition that harnesses the highestcaliber brands and franchises, general entertainment, family programming, news, and industry-leading sports content.

And we have more expansions underway around the world in our parks and experiences than at any other time in our history. With ambitious plans ahead for all our businesses, we’re not done building, and we are excited for Disney’s future.”

Pharma stocks dip on Trump tariff threat

Back in the financial market, European healthcare stocks have hit a three-month low as the threat of US tariffs looms over the sector.

The STOXX Healthcare index has dropped by 1.6% today, to its lowest level since mid-April, early in the Trump trade wars.

Investors are jittery after the US president said Washington would initially impose a “small tariff” on pharmaceuticals firms before raising it to 150% within 18 months, and eventually to 250%, in a bid to boost domestic production.

Top fallers this morning include Germany’s Bayer, who are down 4.7% after reporting a 5.1% drop in earnings, ahead of special items, for the first half of this year.

Last month, the European pharmaceutical industry warned that a 15% tariff on medicines imported from the EU would harm patients on both sides of the Atlantic….

Construction activity is likely to improve over the coming months, predicts Elliott Jordan-Doak, senior UK economist for Pantheon Macroeconomics:

“The Bank of England will likely cut interest rates in August, reducing borrowing costs for businesses, and the shock from tariff uncertainty will continue to fade.

“Moreover, the Government’s focus on investment spending and planning reforms should also provide support to the construction industry.

“The PMI should recover over the coming months.”

UK construction slump: what the experts say

Here’s some early reaction to the tumble in UK construction activity last month:

Gareth Belsham, director of Bloom Building Consultancy:

“There’s no sugarcoating it – this data will be tough to swallow for almost everyone in construction.

“All three subsectors of the industry saw output contract in July, with the sharpest fall coming in civil engineering. Housebuilding, the sector beloved of politicians in need of a photo opp, also declined badly.

“To make matters worse, the pipeline of new work is drying up fast. New order numbers have now fallen for seven months in a row, with July’s slump the worst seen since February.

“Little wonder contractor confidence is weak and many construction firms are laying off payrolled staff.

“June saw sentiment plunge to its lowest level since December 2022, and while July’s figure improved marginally, even the most optimistic of builders will find it hard to see the glass as half full.

Brian Smith, head of cost management and commercial at infrastructure consultancy firm AECOM:

“A slower summer for construction reflects ongoing caution in the market, with clients holding back decisions amid cost pressures and capacity concerns. This marks the seventh consecutive month of declining activity, but clearer direction from government is helping to steady sentiment and reframe expectations for the second half of the year.

“The new Infrastructure Pipeline marks a welcome shift from strategy to delivery. It provides the long-term certainty the sector needs to plan and prioritise, with 780 public and private sector projects worth £530bn helping to define the scale of opportunity ahead. A stable pipeline, insulated from political cycles, is essential to unlocking growth and driving efficient delivery.

“But the scale of what’s set out in the pipeline cannot be delivered without the right capacity in place. Labour shortages remain a challenge across the sector, particularly in technical and delivery roles. Turning visibility into progress will require investing in the people and skills needed to build at pace.”

Max Jones, director of infrastructure and construction at Lloyds:

“Despite a challenging month, signs of recovery are emerging across the UK construction sector. Easing inflation has likely helped to stabilise core material costs including steel, concrete and aggregates. This has also potentially helped to operate supply chains more smoothly, improve project delivery and protect margins.

“However, with increased investment, progress on planning reform, and plans to expand their project pipelines, firms are likely to feel encouraged that more positive months are ahead.”

UK interest rate cut tomorrow looks nailed on

The contraction in UK construction last month is another reason for the Bank of England to consider cutting interest rates at noon tomorrow.

A rate cut, from 4.25% to 4%, is already widely expected – it’ s a 95% chance, according to the City money markets this morning.

Andy Burgess, fixed income investment specialist at Insight Investment, says:

“The Bank of England is widely expected to cut rates this week in what is likely to be a complex decision as the MPC weighs weak growth, sticky inflation, and a looming fiscal tightening.

While markets are pricing in a 0.25% cut, attention will centre on the voting split – particularly how many members vote for a 0.5% move or prefer to hold.

Burgess adds that the rhe Bank has a narrow window to cut rates ahead of the autumn budget.

Looking ahead, UK construction firms are – on balance – optimistic about growth over the next year.

However, expectations are weak when compared with their long-run trend, with business confidence rising slightly from June’s two-and-a-half-year low.

Builders keep shedding staff

With activity falling, construction firms kept laying off staff last month.

This morning’s construction PMI report shows that the downward trend in payroll numbers continued into July, meaning employment levels have now fallen for seven months.

Builders reported lay-offs, recruitment freezes and the nonreplacement of leavers, and also cut back on their use of subcontractors.

Some construction firms have reported a drop in work undertaken on public sector projects in July.

This led to civil engineering showing the sharpest drop in activity during July, followed by housebuilding and then commercial work.

UK construction activity falls by most in five years as residential building drops

Ouch! Activity in the UK construction sector has fallen at the fastest rate in over five years, indicating the government is struggling to hit its housebuilding targets.

Data firm S&P Global has reported that there was “a considerable slump in the UK construction sector” in July, as builders reported a renewed decline in housing projects.

That is a sign that Labour are falling behind in their target to boost housebuilding and build 1.5 million new homes by 2029.

Commercial construction, and civil engineering, both also shrank in July.

S&P Global says:

Underlying data highlighted marked decreases in volumes of work carried out across all three monitored sub-sectors, but a considerable drag came from a fresh drop in residential building.

This pulled the S&P Global UK Construction Purchasing Managers’ Index (PMI) down to posting 44.3 in July, from 48.8 in June.

Any reading below 50 shows a contraction, and today’s data signals the sharpest contraction in over five years.

Builders blamed site delays, lower volumes of incoming new business and weaker customer confidence for falling activity in July.

Joe Hayes, principal economist at S&P Global Market Intelligence, says UK construction suffered “a fresh setback” in July, explaining:

Dissecting the latest contraction, we can see a fresh and sharp drop in residential building, as well as an accelerated fall in work carried out on civil engineering projects.

Forward-looking indicators from the survey imply that UK constructors are preparing for challenging times ahead. They’re buying less materials and reducing the number of workers on the payroll. Expectations also continue to underwhelm, despite a modest pick-up in confidence from June’s two-and-a-half-year low.

FTSE 100 inches closes to record high

London’s main share index is inching closer to the record high struck at the end of last month.

The FTSE 100 share index traded as high as 9184 points this morning, just 6 points away from the intraday high of 9190 hit on 31 July.

Insurance group Hiscox are the top riser, up 8.6%, after beating profit forecasts this morning and lifting its dividend despite “the largest wildfire insurance event in history”.

Victoria Scholar, Head of Investment at interactive investor, says:

“The FTSE 100 is trading slightly higher, although earnings reports are stemming an even greater gain for the index. Glencore is down around 3.5% after the miner reported a drop in first half profits and Legal & General is down a similar percentage, disappointing investors despite an earnings beat.”

Chris Beauchamp, chief market analyst at IG, says:

“London’s listing authorities will breathe a sigh of relief over Glencore’s plans to stay on the LSE, mainly since it seems unlikely it can make the S&P 500.

It’s been a gloomy update overall from Glencore, which has suffered from the dire performance of coal prices, though recent improvement there and in cobalt provides hope that they can turn the ship around in the second half.”

Glencore scraps plans to move stock market listing away from London

There’s some good news for the City this morning: mining giant Glencore has decided not to quit the London stock market in favour of New York.

Glencore told shareholders this morning that it has completed its analysis of potential alternative listing options, and concluded that shifting its listing to the US did not make sense.

Glencore explained:

Of the major global equity exchanges, the scale and depth of US capital markets is unrivalled, but having considered the costs and benefits, including in respect of indexation, we do not believe that becoming a US domestic issuer or having a sponsored ADR program [an American depositary receipt] would be value.

Back in February, Glencore said it was considering moving its primary share listing away from London, a journey already taken by major companies such as gambling firm Flutter.

Glencore also reported a 14% drop in adjusted profits in the first half of the year, on an EBITDA basis, as it suffered from weaker coal prices and lower copper production.

Glencore’s chief executive officer, Gary Nagle, says:

“While there is much uncertainty around the impacts of geopolitics and trade in the shorter-term, we remain of the view that, in certain commodities, the scale and pace of required resource development will struggle to meet the demand projections for such materials into the future.

We are well placed to participate in bridging this gap, through the flexibility embedded in both our Marketing and Industrial businesses to respond to global needs.”

Honda Motor quarterly profit halves as tariffs bite

Profits at Japanese automarket Honda have halved in the last quarter, as Donald Trump’s trade war hit their earnings.

Honda, which is Japan’s second-largest carmaker, has reported quarterly operating profit of ¥244.2bn (£1.24bn) for April-June, missing analyst forecasts of ¥311.7bn.

Honda said the 27.5% tariffs on auto imports imposed by the US, pulled down its operating profit for the quarter by about ¥125bn.

But the automaker said the impact from the tariffs on its full-year operating profit was smaller than it had estimated in May. It now expects a ¥450bn yen hit for the year, compared to ¥650bn forecast previously.

But in better news, Honda now believes tariffs will have less impact on its full-year operating profits than previously forecast. It now expects a ¥450bn hit this year, down from ¥650bn forecast previously.

The company raised its full-year operating profit forecast to 700 billion yen from 500 billion yen, and said it expected the yen to trade at a weaker rate than it had previously estimated, Reuters reports.

Last month, the US and Japan agreed a trade deal under which tariffs on Japanese cars would drop to 15%. However, a timeframe for the change to go into effect was not announced; yesterday, Japan’s top tariff negotiator Ryosei Akazawa headed to Washington to try to hammer this out…

Introduction: OpenAI in talks for share sale at $500bn valuation

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The artificial intelligence boom is continuing to excite investors, creating the possibility of huge earnings for the companies and individuals at the heart of the AI race.

Overnight, news has broken that OpenAI, the group behind the ChatGPT chatbot, is in talks about a share sale that would value the company at $500bn.

That would be a serious jump on OpenAI’s previous valuation of $300bn, set in a financing round in March, and underline its status as one of the largest privately held companies in the world.

The talks centre on a potential sale of stock for current and former employees, Bloomberg reports, adding that existing investors including Thrive Capital have approached OpenAI about buying some of these shares. As OpenAI isn’t listed on the stock market, such a secondary stock sale would allow present and ex-staff to cash in.

The mooted share sale comes as companies race to test, and roll out, artificial intelligence systems, which has sent the value of chipmaker Nvidia surging to over $4tn last month.

Shares in Palantir, the software analytics and AI company, jumped almost 8% yesterday after it beat Wall Street estimates and hiked its full-year guidance due to the artificial intelligence boom.

OpenAI is riding this wave too. The Financial Times reports that OpenAI’s annual recurring revenue — a measure of expected revenue from subscriptions commonly used by start-ups — has surged to $12bn, and the company is apparently expecting $20bn or more in ARR by the end of 2025.

Yesterday, OpenAI launched new freely available artificial intelligence models, in a challenge to rivals including Mark Zuckerberg’s Meta and Chinese rival DeepSeek.

The ChatGPT developer has announced two “open weight” large language models, which are free to download and can be customised by developers

Sam Altman, OpenAI’s chief executive, said the company was excited to add to a stack of freely available AI models “based on democratic values … and for wide benefit”, adding:

“We’re excited to make this model, the result of billions of dollars of research, available to the world to get AI into the hands of the most people possible.”

The agenda

-

7am German factory orders for June

-

8.30am BST: eurozone construction PMI report for July

-

9.30am BST: UK construction PMI report for July